In the world of SAAS, PaaS, and IaaS, it’s not just about making cool software people love to use. We designers need to understand how the money side of things works.

This means knowing:

- How does the company make money regularly?

- How much does it cost to get a new customer?

- How much money does a customer bring in over time?

- How often do customers stop using the service?

It’s also important to know about different ways to make money, like subscription plans, free versions that offer paid upgrades, and different service levels that customers can choose from.

In this guide, I will share the top financial essential models for making better design decisions.

To save some time here are key takeaways:

- Financial metrics such as Recurring Revenue, CAC, LTV, and Churn Rate are essential for tracking performance and forecasting future growth.

- Revenue models like subscription-based pricing, freemium strategies, and tiered services enable SaaS designers to tailor offerings to customer needs and maximize revenue.

- Data-driven design decisions are crucial for optimizing user experience and aligning product offerings with market demand.

- Understanding and analyzing these metrics and models are critical for strategic decision-making, helping to balance investments and drive market penetration.

- Regularly reviewing and adjusting SaaS financial strategies based on these metrics can lead to increased customer retention, higher revenue, and a stronger competitive position.

Importance of Recurring Revenue

As we learn more about business, I’ve found out that for any business that charges its customers regularly, like monthly or yearly, the most important thing is its steady income.

This is the money the business can count on getting from its customers regularly.

Here’s why it’s so important:

- It provides a stable financial base, allowing for more accurate forecasting and planning.

- It ensures a steady cash flow, which is essential for covering ongoing operational costs.

- It builds a foundation for scaling the business, as predictable revenue makes it easier to invest in growth initiatives.

Recurring revenue isn’t just about stability, it’s about the promise of continuity.

When customers commit to a subscription, they’re not just buying a product or service — they’re entering into a relationship with your brand.

This relationship, if nurtured properly, can lead to long-term loyalty and increased customer lifetime value.

Tip: Always monitor your recurring revenue streams closely. They are a key indicator of your business’s health and potential for long-term success.

1. Customer Acquisition Cost (CAC) and Its Impact

In my journey as a designer in the SaaS space, I’ve learned that Customer Acquisition Cost (CAC) is not just a number.

It’s a reflection of the efficiency of our marketing efforts. It’s crucial to keep a close eye on CAC because it directly affects the company’s profitability and long-term sustainability.

Optimizing CAC is about finding that sweet spot where the cost of acquiring a new customer is significantly less than the revenue they bring over their lifetime with the company.

Here are a few strategies I’ve employed to manage CAC effectively:

- Working on better ways to keep customers by improving help for customers and updating the product.

- Starting programs that encourage current customers to tell others about the service.

- Putting money into creating good content and search engine optimization to grow naturally.

- Making the process of buying smoother to increase the number of people who decide to buy.

Remember, the goal is to achieve a CLV that is at least three times the CAC. This is a standard benchmark in the industry that indicates a healthy balance between acquisition costs and customer value.

By focusing on these areas, I’ve been able to contribute to reducing CAC and sustainably driving growth. It’s a continuous process of testing and learning, but the rewards are well worth the effort.

2. Lifetime Value (LTV) of a Customer:

How to Figure It Out and Why It Matters

Figuring out the Lifetime Value (LTV) of a customer is super important for knowing how much profit we can expect to make from a customer over time in our SaaS business.

It’s like predicting how much money we’ll make from a customer for as long as they’re with us.

Here’s how I break it down:

- First, I figure out the average amount a customer spends and then multiply it by how often they buy something to get the customer’s value.

- Next, I find out how long, on average, a customer stays with us and multiply that by the customer’s value to work out the LTV.

The importance of LTV is really big. It shows me how much money I can spend to get new customers (CAC) and still make money.

A high LTV means our customers really like our service and will probably stay with us. This shows that our product is good and fits well in the market.

Remember, a healthy balance between LTV, CAC, and churn rate is essential for sustainable growth.

A high LTV coupled with a low CAC and churn rate often signals a robust and thriving customer base.

By often checking the LTV, I can smartly decide where to use our resources, like making the product better, improving how we help customers, or making our marketing better.

LTV is a key number that helps me plan many parts of my strategy.

3. Churn Rate: Monitoring Customer Retention

Understanding and controlling the churn rate is very important for the lasting success of any SaaS business.

It shows how good your service is at keeping customers for a long time. To manage this number well, I use several important strategies:

- Reaching out to customers proactively: Regularly talking to customers with surveys, emails, or calls helps spot problems early.

- Customized welcome process: Making the welcome experience fit each customer can help keep new customers from leaving quickly.

- Programs for referrals and loyalty: Motivating current customers to bring in new ones can balance out churn by adding new subscribers.

Remember, the goal is to understand why customers leave and address those reasons before they affect others.

Churn can be expressed in terms of renewal rates as well. A renewal rate above 90% is a strong indicator of customer satisfaction and a low churn rate. However, it’s important to note that ‘acceptable’ churn rates can vary.

For example, a SaaS that works with small and medium-sized businesses might be okay with a higher churn rate because small businesses often change a lot.

On the other hand, a SaaS that serves big companies should try to keep their churn rate under 10% to keep their business strong.

Pricing Plans Based on Subscriptions

As we learn more about the world of SaaS (Software as a Service), I’ve begun to appreciate how neat subscription-based pricing plans are.

This method of setting prices ensures a steady and reliable flow of money, which is very important for managing my money and keeping everything stable.

Here’s how I do it:

- First, I figure out what makes my service special and choose a starting price that shows this value.

- Next, I think about what different users might need and make different levels of service. This lets customers pick the service level that fits them best.

- Lastly, I make sure the subscription comes with regular updates and help, which improves the overall quality of the service and makes customers happier.

Tip: Always keep an eye on market trends. For instance, with the shift towards consumption-based pricing, as seen with Snowflake’s success.

I’m exploring credit-based models that could offer more flexibility to my upcoming saas product called Crito Design.

Italics are crucial here, as they remind me to stay agile and adaptable. The landscape of SaaS is ever-changing, and so must my pricing strategies.

By staying informed and flexible, I can navigate the complexities of SaaS financials and maintain a competitive edge.

If your company uses Google Analytics to help make design decisions, this article is meant for you

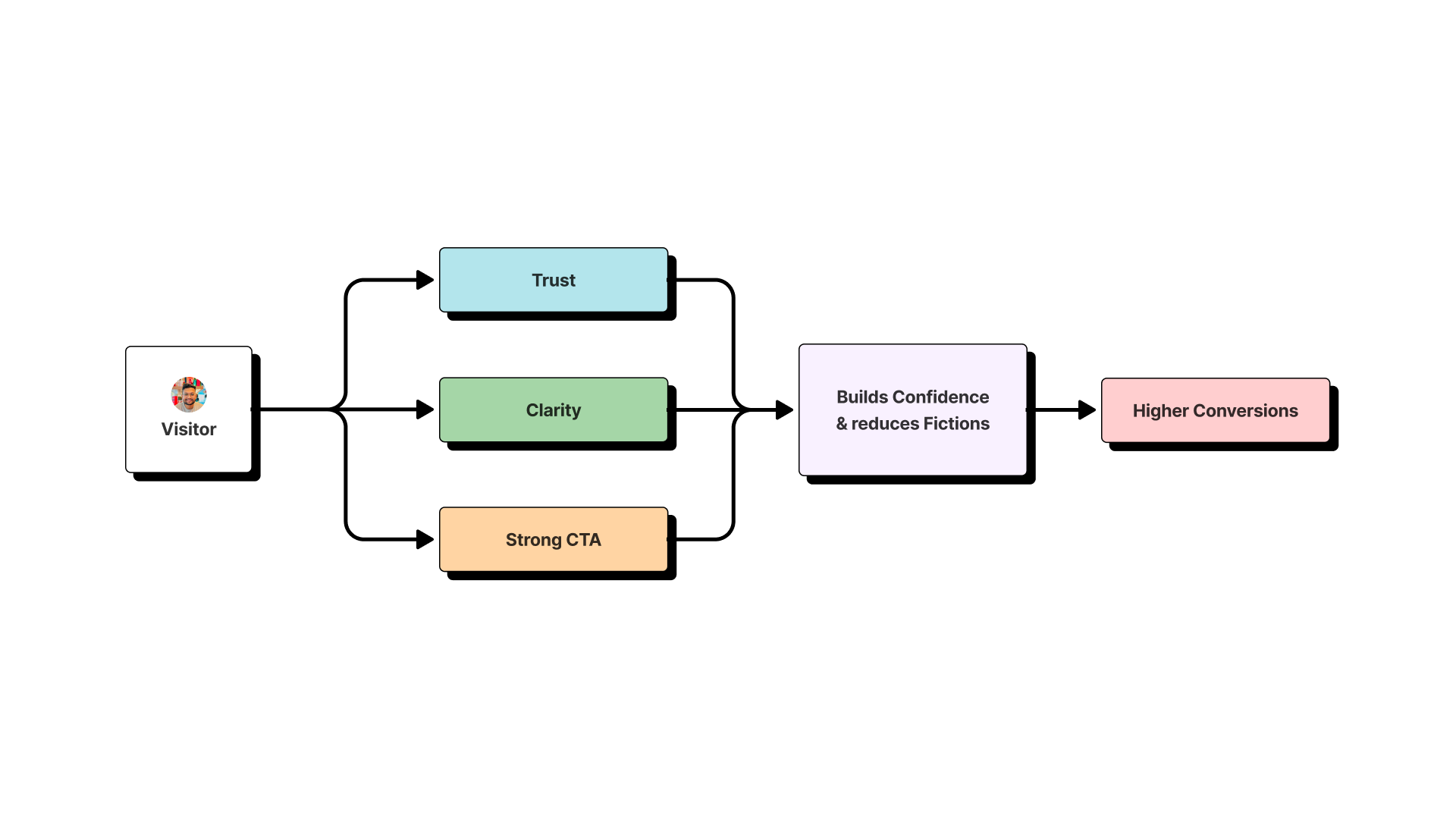

Freemium Models and Conversion Tactics

I’ve come to appreciate the power of freemium models as a strategy to attract a broad audience and kickstart the growth of a SaaS business.

By offering a version of my software for free, I can showcase its value and encourage users to upgrade for more advanced features.

Here’s how I approach this model:

- Offer a robust free version that provides genuine value to users.

- Ensure the transition to paid features is seamless and compelling.

- Use customer behavior triggers to deliver personalized emails, enhancing the user experience.

Personalization and automation are key in converting free users to paying customers. It simplifies the process and ensures that the right message reaches the right person at the right moment.

Moreover, providing trial periods or versions allows potential customers to explore the features, building trust and familiarity with the product.

Remember, the goal is not just to attract users but to convert them into loyal customers. Implementing referral programs can further leverage user satisfaction by turning them into advocates for your software.

In the fast-changing world of SaaS, designers, and financial planners can use important financial numbers and revenue plans to make better decisions and grow their businesses.

By knowing and using important measures like ARR (Annual Recurring Revenue), churn rates (how many customers leave), and net revenue retention (how much money is kept after losses), businesses can keep track of steady income and predict future money flow.

Using these key insights lays the groundwork for successful strategies and financial growth. Remember, in SaaS, understanding these concepts is the key to being good at it.

With the right tools and knowledge, your financial reports can stand out and lead to success in the competitive SaaS world.

Want to know what’s hot in business for 2023? The Ultimate Guide to Google Analytics 4.